Our Finances Explained

On Thursday, September 11, the Butler County Board of Developmental Disabilities (BCBDD, the Board) passed a resolution declaring the Board to be in a state of fiscal emergency due to the fact that our projected expenses will far exceed our local tax collection for the first quarter of 2027.

It’s important to understand three key factors: How did we get here? What are we doing now? And what do we need to do?

How we got here: Understanding Board Funding

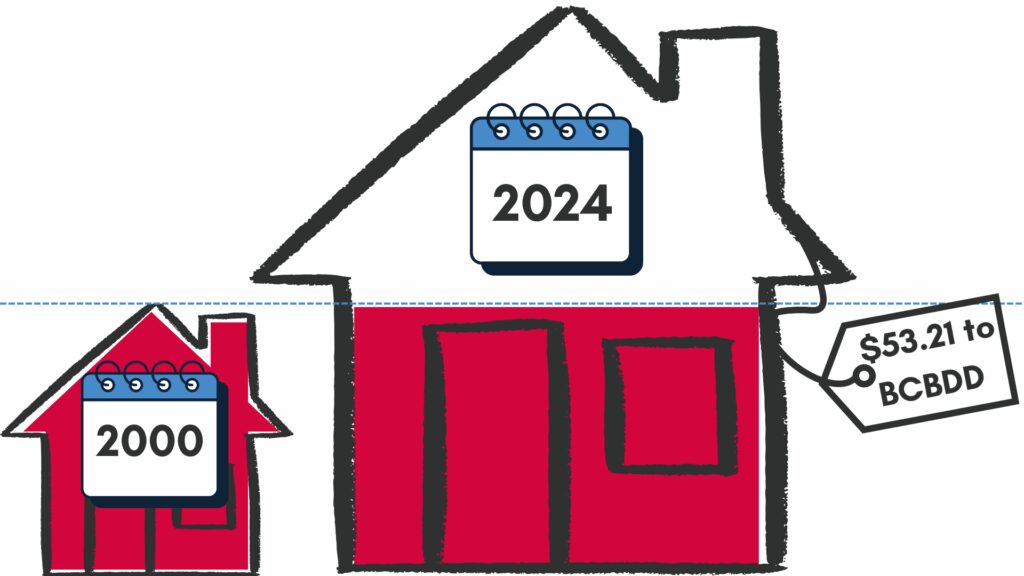

The Butler County Board of Developmental Disabilities operates on a 2-mill property tax levy passed by voters in 2000 and a 1-mill property tax levy passed in 2004. We serve over 4,200 residents of Butler County and our supports span throughout a lifetime.

At the time the levy passed, taxpayers paid $53.21 for a $100,000 home. In the year 2000, the average single-family home in Butler County was valued at around $113,000. Since then, the median single-family home has appreciated by 110%. But for us? We’re still collecting on the value assigned when the levy was passed. In 2025, these levies account for around 80% of our overall revenue collections.

Meanwhile, the costs of providing services has skyrocketed.

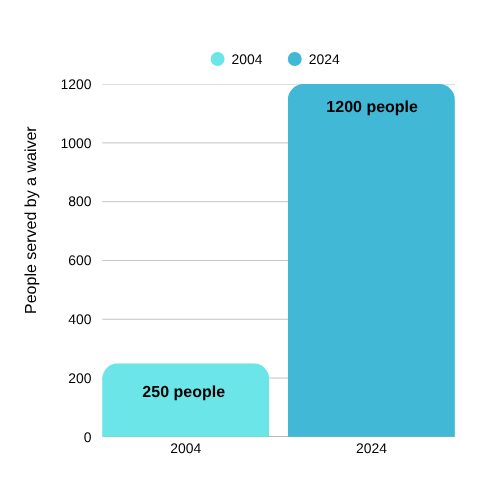

One of the primary uses of taxpayer dollars is to support waivers. That is, to provide funding so that people with developmental disabilities can safely live, work, and be a part of the community rather than spend their lives in an institution.

We cover about 40% of the cost of waivers through that property tax, while around 60% of the cost of the waiver is covered through federal Medicaid funds.

Back in 2004, when we passed our last levy, we supported 250 people through a waiver. By 2024, that number has risen to over 1,200. And it continues to climb at a steep ascent. This type of support is federally mandated. We’re not capable of simply turning people away – nor would we want to.

To remain fiscally solvent, we’ve made some dramatic changes over the years: We have transitioned our day program services to providers in the community, consolidated facilities and reduced our workforce. It has allowed us to stay off the ballot for over 20 years while creating little to no disruption to services.

At the request of county officials, we even gave about $7.2 million back to taxpayers via a rollback in 2020 and 2021.

Costs continue to climb, though, and revenue (including tax collections) remains stagnant.

What are we doing now?

We’re now at a tipping point; action must be taken. Below are just a few of the steps we’ve taken recently to temporarily relieve our financial situation.

- Declaring a fiscal emergency: Our Board has taken action to implement a financial savings plan and seek assistance from the Ohio Department of Developmental Disabilities.

- Raises and increases: We have paused all wage increases including cost of living adjustments for our staff.

- Reduced hours: All full-time staff will take a 2.5-hour reduction in working hours, which works out to a 6.67% decrease in pay on top of the lost cost-of-living increase.

- Promotions and vacancies: All promotions are on freeze and all vacated positions will be scrutinized before posting.

- Family Support Services Funding (FSS): In 2026, Family Support Services funding will be reduced by 50% and limited to camps and respite. Family Support Services was created to fill gaps for families that are not enrolled in waiver services. Despite this reduction, our staff will be working hard to find other resources for funding and lower-cost alternatives for families.

- Reduction in Locally Funded Services: At this time we will be prioritizing our community employment supports and transportation for competitive work. All other requests will be considered on an individual basis and determined by budget available.

What do we need to do?

Using a ten-year cash flow to forecast our financial situation, our Board has been monitoring the need to return to voters for many levy cycles. Our county commissioners are careful to not burden taxpayers with multiple social service levy requests at a time. Therefore, we are aggressively cutting costs where we can until we can return to voters.

With county approval, we expect to be placed on the ballot for the May 2026 election.

More than 21 years ago, Butler County voters made a commitment to support their neighbors, family, and friends with developmental disabilities. We take our work seriously, knowing we have a responsibility to honor that commitment, to actively partner with people to access the world.

Have questions or want to connect with us further on this? Reach out to info@butlerdd.org.

Updated: 10/8/2025